Key Messages

- Income inequality is widening across the country.

- The usual funding models won’t do anymore; CDFIs need to tap into capital markets.

- To succeed in a volatile and changing market, CDFIs need to be resilient, looking for new and varied funding models.

- The power of partnerships can support CDFIs to continue creating impact for communities.

- Organizations like Momentus Securities can provide guidance and access to capital markets for CDFIs and community lenders.

Talk to our team about your capital markets readiness.

As president of Momentus Securities, a mission-driven investment bank, I was honored to participate in a convening of Community Development Financial Institution (CDFI) leaders and funders about the state and future of the CDFI industry, hosted by the Federal Reserve Bank of Chicago in late 2025.

The central question was: What do CDFIs need to get right in the next 10 years in order to be around for the next 30 years?

Below are 10 key takeaways Momentus Securities identified as emerging from the discussions—insights we heard from CDFI lenders and funders that we hope will continue to spark collaboration and action across the field.

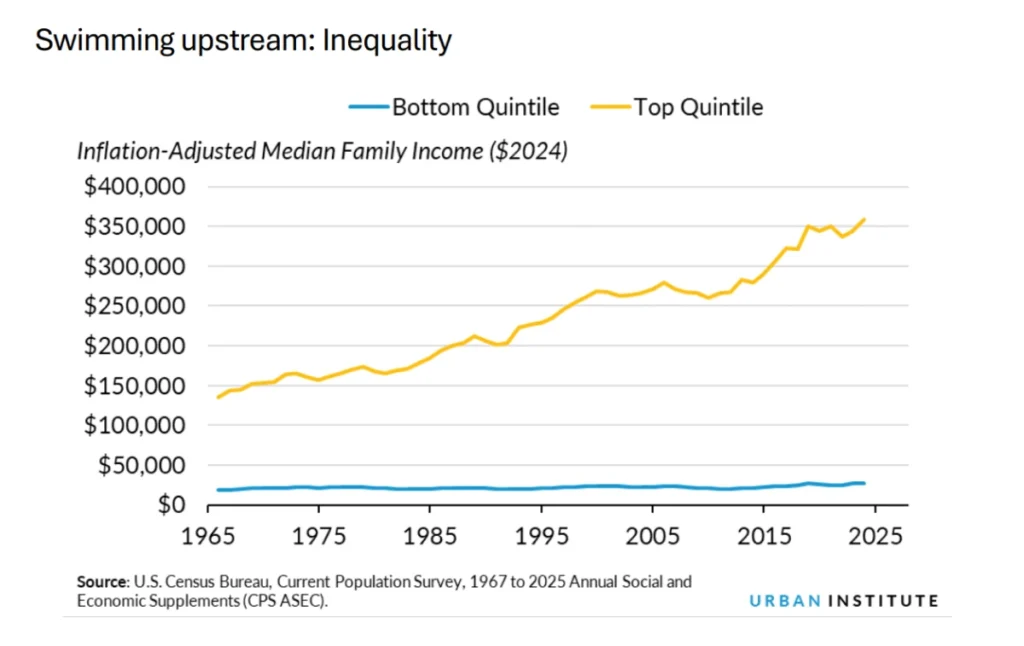

1. The Inequality Backdrop is Stark

The Urban Institute shared data from the Current Population Survey that shows an increasing gap between median family income (before transfers and taxes) at the top and bottom quintiles. This analysis, which will be shared as part of a forthcoming report (due out in 2026) provided a stark backdrop to the work of CDFIs. The need for CDFI products and services is as high as ever. Tackling the wealth gap is going to require new approaches that unlock capital at scale.

2. No Turning Back

The operating environment has changed and may change again. In addition to funding obstacles, CDFIs are facing other challenges from staffing and technology to borrower affordability, credit, and collateral issues. Resilience will require anticipating volatility and diversifying funding models.

3. Resilience Requires New Tools

CDFIs face persistent liquidity challenges due to limited access to both primary and secondary market financing. This prevents them from recycling capital efficiently and expanding lending. To thrive, CDFIs must strengthen their access to capital markets and new investor classes, not just rely on legacy funding streams.

4. Philanthropy Can’t Fill the Funding Gap

Philanthropic dollars can be catalytic, but can’t meet all funding needs. Long-term sustainability depends on unlocking scalable, market-based capital aligned with mission.

5. Capital Markets are a New Frontier for Many

Some in the sector have real questions about what it means to access capital markets:

- Potential loss of flexibility with borrowers

- Affordability of market-rate capital

- Lack of scale to access certain tools

While these questions can cause anxiety, there are solutions to each. The field must experiment and learn by doing rather than letting uncertainty paralyze innovation.

6. Intermediation Matters

Large investors want to deploy more capital into CDFIs, but face transaction cost barriers. Purpose-built intermediaries can streamline access, aggregation, and underwriting to channel capital efficiently across the sector. Growing intermediation is actually a reflection of the increased scale and complexity that the field has achieved.

Momentus Securities was built to support CDFIs and community lenders to meet these moments. Our target client base includes community-serving financial institutions all working to improve access to vital services like affordable housing, education, health care, and small business opportunities. We aim to provide our clients with the highest-quality advice and execution for traditional and alternative capital solutions. Additionally, we assist our clients in both primary and secondary markets to secure financing via public bond and note issuances, private placements, structured credit transactions and asset sales.

7. Collaboration Needs Intentional Design

Mission alignment alone doesn’t guarantee partnership across CDFIs. Without clear incentives, the default mode is competition — for borrowers, funders, investors, and talent. When collaboration has happened, it is often because the money drives it and/or the partnership was complementary and not redundant. CFDIs are often worried that if they partner, the existing funding will not go from 1+1=2, but rather 1+1=1.5.

8. Innovation Through Constraint

Entrepreneurs outside the CDFI field remind us that constraint fuels creativity. “Grow, change, or die,” was relevant 20 years ago and is even more pressing today. For CDFI lenders, innovation and resilience will go hand-in-hand.

9. Data, Data, and Data

The sector needs different types of data and better data infrastructure to support measuring, managing, and communicating CDFI impact and effectiveness.

10. The Power of Community and Continuity

The gathering reminded everyone of the field’s deep experience, camaraderie, and resilience. Taking time to step back from the day-to-day to think long-term is important for effective leadership.

Reach out to Momentus Securities to identify the right capital markets strategy for your institution.