August 7, 2025 (New York, NY) – Momentus Securities, LLC, and Mesirow Financial, Inc., have structured and managed one of the largest bond offerings ever by a community development financial institution, or CDFI.

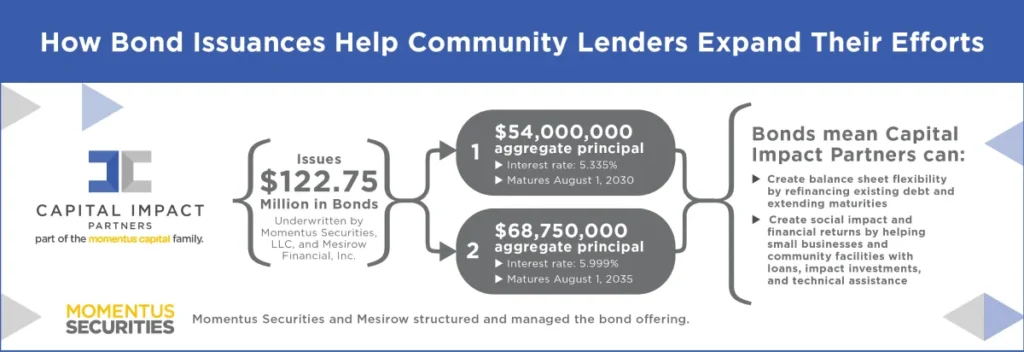

Capital Impact Partners, one of the nation’s foremost CDFIs, has issued $122,750,000 aggregate principal amount of Taxable Bonds, Series 2025-1 (the “Bonds”), which closed on July 30, 2025. The Bonds were rated A+ by S&P Global.

The Bonds were issued in two tranches, with $54,000,000 aggregate principal amount issued at an annual interest rate of 5.335% and maturing on August 1, 2030; and $68,750,000 aggregate principal amount issued at an annual interest rate of 5.999% and maturing on August 1, 2035.

Capital Impact Partners will use net proceeds from the issuance of the Bonds to repay outstanding debt. By tapping into the capital markets to create balance sheet flexibility and further diversifying its debt sources, this transaction allows Capital Impact Partners to expand its lending, investments, and programmatic efforts to better support the creation and expansion of small businesses and community facilities in communities nationwide.

“Community development financial institutions, and other community lenders such as certified development companies (CDCs) and credit unions, need more liquidity in order to help support economic growth throughout the United States, but they have long been unable to utilize the mainstream capital markets as a resource,” said Jaime Aldama, President of Momentus Securities, an SEC-registered broker-dealer, a MSRB-registered municipal advisor, and a FINRA/SIPC member. “We hope this successful bond closing will demonstrate the value of transactions like these for both the issuer and the investors.”

“The success of Capital Impact Partners’ bond issuance is a testament to the organization, its financial strength and its impact,” said Brian Prater, Managing Director, Mesirow Public Finance. “Mesirow was honored to partner with Momentus Securities to provide a new channel for Capital Impact Partners to access the capital markets.”

Historically, impact-focused organizations have had limited exposure and access to the capital markets. The lending done by these organizations is often not at a scale that appeals to investors, nor has it been cost-effective for these organizations to utilize the capital markets to obtain more liquidity.

How Does a Bond Work?

Bonds are a way to raise money from investors. The bond issuer receives the money it is seeking and promises to pay back the investor the principal loan amount plus interest, which may be at a fixed or floating rate. The interest payments are made over the term of the bond, and the principal amount is due on the maturity date.

For example, one tranche of the bonds issued by Capital Impact Partners was $54 million aggregate principal amount issued at an annual interest rate of 5.335% and maturing on August 1, 2030. That means those who invested in these bonds will receive interest payments of 5.335% on an annual basis (payable semiannually) until August 1, 2030, the date at which the $54 million is due to be repaid.

Bond issuers are able to utilize the funding for a variety of needs, while bond investors are able to recoup their loan while benefitting from the interest payments they receive.

Often, when bonds are issued, a ratings agency will assign a credit rating based on its analysis of the bond issuer’s ability to repay the loan. The stronger the rating, the more confidence an investor should have in receiving repayment. S&P Global lists explanations for what each of its credit ratings means.

How Momentus Securities Connects Mission-Driven Lenders with Institutional Investors

Momentus Securities is a different kind of investment bank that exists to help mission-driven and community-focused lenders who drive the economy throughout the United States. Momentus Securities works to bring down the costs of accessing the capital markets, and also is able to create the scale that investors are seeking by aggregating portfolios of loans made by all lenders throughout the United States, including mission-driven lenders.

These strategies ideally make it easier for investors who have been seeking investment-grade opportunities that not only could make a market-rate return, but would also make a difference.

Momentus Securities works to remove the logjam that mission-driven lenders such as CDFIs, CDCs, community banks, and credit unions often run into. These lenders want to support more small businesses and community development efforts. Yet they can’t scale up unless they have more liquidity. And they can’t get more liquidity unless they access more debt or move loans off their balance sheets.

Momentus Securities helps create more liquidity by:

- Creating warehousing lines to finance loans in anticipation of securitization.

- Aggregating portfolios of loans across mission-driven lenders throughout the United States.

- Helping its clients raise debt capital via bond and note issuances, private placements, and structured credit transactions.

- Providing public and private placement services for municipal issuers, public agencies, private developers, nonprofit organizations, and other mission-driven borrowers.

- Providing secondary market liquidity for community-centric organizations focused on America’s communities.

This means that institutional investors will have the opportunity to invest in those products — and therefore support communities.

Momentus Securities also:

- Provides capital raising services to help its clients grow by leveraging an extensive network with impact-driven institutional investors and foundations.

- Offers credit rating advisory services in all ratings considerations, including first-time ratings, rating upgrade/defense, capital structure optimization, and debt capacity analysis.

- Provides liability management and capital advisory services to help clients optimize their capital structure and improve their financial strengths.

###

About Momentus Securities

Momentus Securities, an SEC-registered broker-dealer, a MSRB-registered municipal advisor, and a FINRA/SIPC member, offers a range of financial products and services to support its mission of connecting mainstream capital sources and impactful investment opportunities. These services include debt and equity capital raising, asset-backed and structured finance as well as corporate finance and advisory services. Momentus Securities seeks to bolster the mission-driven investing space by addressing the current scale and liquidity limitations in the sector that inhibit the deployment of institutional capital.

Momentus Securities is part of the Momentus Capital branded family of organizations, which also include, among other organizations, Capital Impact Partners (a nonprofit Community Development Financial Institution, or CDFI) and CDC Small Business Finance (a leading SBA Community Advantage Small Business Lending Company, or CA SBLC).

About Mesirow

Mesirow is an independent, employee-owned financial services firm founded in 1937. Headquartered in Chicago, with offices around the world, we serve clients through a personal, custom approach to reaching financial goals and acting as a force for social good. With capabilities spanning Private Capital & Currency, Capital Markets & Investment Banking, and Advisory Services, we invest in what matters: our clients, our communities and our culture.